Automation is rapidly transforming the legal industry, and case management is no exception. By integrating automation tools, law firms can substantially improve their efficiency and productivity. Streamlining tasks such as document review, scheduling, and billing enables attorneys to focus on higher-value work. This leads to improved client satisfaction, reduced costs, and an overall improvement in operational performance.

Outcomes of automation in case management include:

- Lowered administrative burden

- Increased accuracy and efficiency

- Improved client communication

- Faster turnaround times

- Cost reduction

By incorporating automation, legal professionals can handle the complexities of case management more effectively and deliver superior legal services.

Automating Financial Services: Efficiency and Accuracy

Automation represents a pivotal role in revolutionizing financial services, driving significant gains in both efficiency and accuracy. By leveraging sophisticated algorithms and technologies such as artificial intelligence and machine learning, firms can automate various tasks, from transaction processing, to risk assessment.

This automation not only minimizes manual effort and time but also enhances the accuracy and rate of financial operations. Additionally, automation facilitates financial institutions to provide more personalized and efficient customer experiences, fostering greater trust.

A Robotic Revolution in Compliance Monitoring

The realm of compliance monitoring is rapidly undergoing a transformative shift with the advent of advanced robotics. These automated systems are disrupting how organizations maintain adherence to rigorous regulations and internal policies. By leveraging artificial intelligence, robotic inspectors can efficiently process vast pools of data , identifying potential violations with remarkable accuracy and speed.

This automation empowers organizations to minimize risk, optimize compliance procedures, and allocate human resources for more high-level tasks. As robotic compliance monitoring continue to evolve, they hold the promise to revolutionize the future of regulatory compliance across domains.

Team Automation: Empowering Teams for Peak Performance

In today's fast-paced business environment, teams are constantly pushed to achieve greater levels of performance. website Automating routine tasks can be a game-changer, freeing employees to focus on creative initiatives that drive real impact. By implementing automation tools, organizations can enhance operational efficiency, minimize errors, and ultimately maximize team productivity.

- Automating data entry processes may save valuable time for employees.

- Sophisticated automation tools can interpret large datasets to provide actionable insights.

- Integrated automation platforms promote seamless teamwork and streamlined workflows.

Legal Case Tracking System : Enhanced Visibility and Control

A robust Legal Case Tracking System empowers legal professionals with unprecedented transparency into case progress. This sophisticated tool automates the entire case lifecycle, providing a centralized platform for managing documents. Attorneys and staff can efficiently review case updates in real time, ensuring that no critical deadlines or assignments are overlooked.

- Furthermore, a comprehensive system improves collaboration among team members, expediting communication and knowledge transfer.

- With improved visibility, legal professionals can identify potential issues more efficiently.

As a result, a Legal Case Tracking System provides an invaluable asset for law firms and legal departments, improving operational efficiency, accuracy, and client service.

Financial Services Automation: Reducing Risk, Increasing ROI Leveraging Technology for Success

In today's fast-paced and competitive financial landscape, institutions are continually striving for ways to enhance efficiency, minimize risk, and drive profitability. Financial services automation has emerged as a transformative solution, empowering organizations to automate routine tasks, improve accuracy, and ultimately, boost their return on investment (ROI).

By automating processes such as customer onboarding, institutions can free up valuable time and resources that can be diverted toward strategic initiatives. This not only lowers the risk of human error but also streamlines operational workflows, leading to faster turnaround times and improved customer satisfaction.

- Automation empowers financial institutions to efficiently manage regulatory compliance by ensuring adherence to industry standards and reducing the risk of infractions.

- Furthermore, automation can generate actionable data that help institutions make informed decisions for better financial performance.

Embracing financial services automation is no longer just a best practice; it's a necessity for transforming financial institutions and achieving sustainable growth in the long run.

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Michael J. Fox Then & Now!

Michael J. Fox Then & Now! Melissa Joan Hart Then & Now!

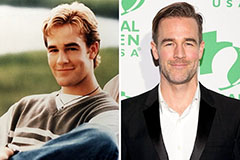

Melissa Joan Hart Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now!